For our MIPCOM 2025 issue, we collaborated with Fabric Data, one of the industry’s leading companies, to deliver an indepth analysis of the crime and true crime landscape. The report shows how the genre continues to hold a strong place in the global audiovisual ecosystem, with more than 69,000 films and 22,000 series, representing about 3% of all distributed titles worldwide. It highlights the steady growth of crime content and shines a light on today’s most popular titles, as well as the growing role of adaptations, franchises, sequels, prequels, and spin-offs in shaping global audience engagement.

Global Landscape

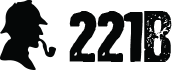

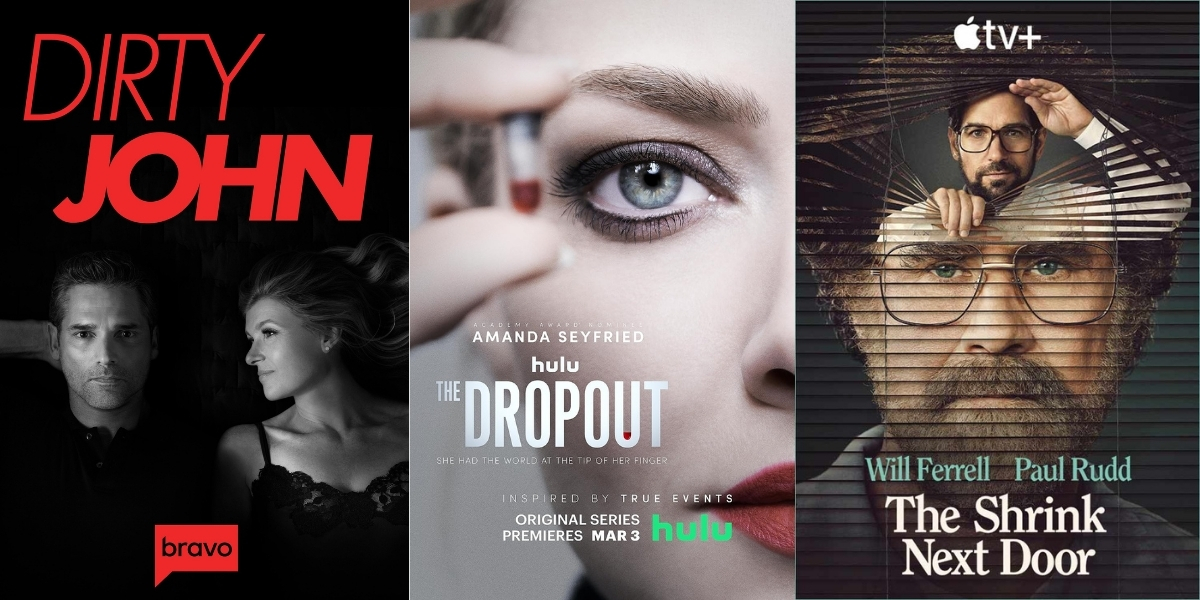

Crime continues to hold a significant place within the global audiovisual ecosystem. Today, there are more than 69K films and 22K series in the genre, representing about 3% of all titles distributed worldwide – a smaller share compared to dominant genres such as Drama (19%) or Documentary (14%). Production and viewership have both grown steadily over the last decade. The United States leads production with more than 13K titles, followed by the United Kingdom (3K) and France (2K). Annual premieres of unique crime titles increased from 4K+ in 2020 to 6K+ in 2024, with 5K+ releases already recorded through Q3 2025.

From a regional perspective, APAC hosts the largest catalog share, with crime titles accounting for 12% of the region’s total library, while EMEA shows the highest audience preference, reaching 47%.

Platforms and Distribution Dynamics

Subscription platforms are central to crime distribution. Prime Video and Netflix dominate across all regions, though their relative weight varies:

• In UCAN, Prime Video leads with nearly 3K titles, while Fubo TV and Netflix range between 1.5K–2.3K each.

• In EMEA, the landscape is more fragmented, with strong catalogs also on SFR Play, Freenet, and Okko. When it comes to original productions, Netflix is the clear leader with 1K+ crime originals, far ahead of HBO Max (204) and Prime Video (201).

Narratives, Audiences, and Thematic Evolution

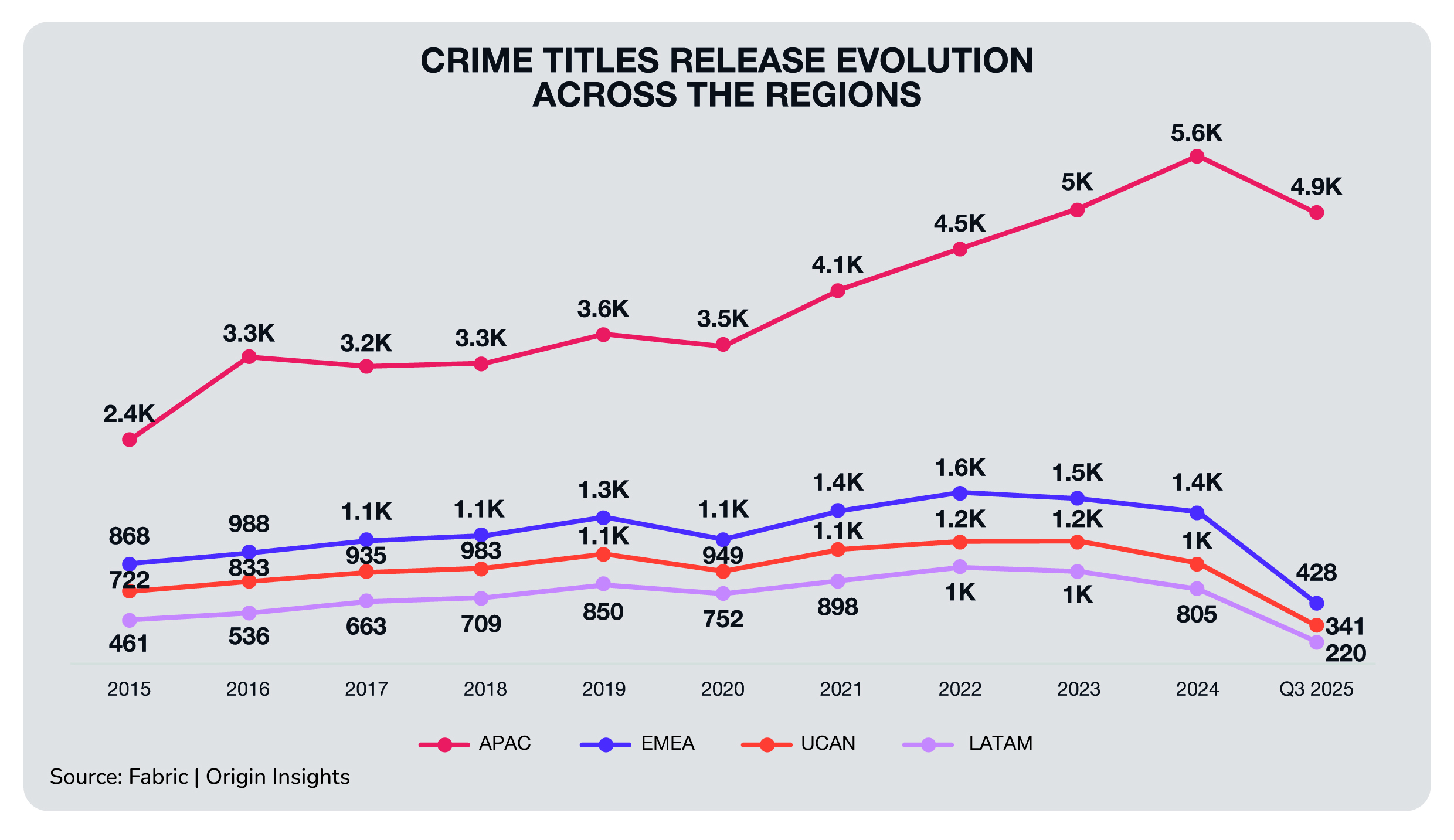

2025 has already delivered high-profile crime releases such as Dexter: Resurrection (2025), starring Michael C. Hall, marking the actor’s return to his iconic role from the original series, and The Hand and the Cult of the Blood Sapphire (2025). Both titles ranked among the most popular globally in Q3 2025.

Adaptations remain a strong driver of new content. So far this year, over 50 crime adaptations have been launched, including +20 literary adaptations such as Bosch: Legacy (season 3), Reacher (season 3) and The Åre Murders.

Shared Universes and Crime Franchises

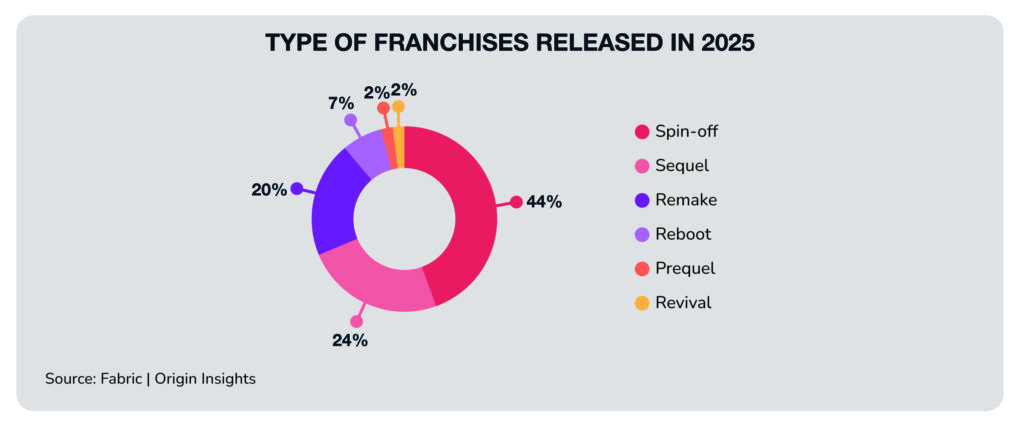

Beyond growth in sheer volume, crime also expands through franchises, sequels, prequels, and spin-offs.

• Netflix leads with global sagas like Money Heist (La Casa de Papel, 2017), which expanded into Money Heist: Korea and Berlin (2022), and more recently with the launch of the first season of In the Mud (Spin-Off, 2025)

• Prime Video leveraged the success of Bosch (2015) into Bosch: Legacy (3rd season).

The case of Dexter illustrates how IPs evolve across formats:

• Spin-off: Dexter (2006)

• Revival: Dexter: New Blood (2021)

• Prequel: Dexter: Original Sin (2024)

• Sequel: Dexter: Resurrection (2025)

Other notable examples include:

• Revival: Law & Order: Criminal Intent (2024), NCIS: Origins (2024)

• Spin-off: Criminal Minds: Evolution (2022), CSI: Vegas (2021)

• Canned series with lasting impact: Bosch (2015), Criminal Minds (2017)

Together, these dynamics confirm that franchising is central to the genre’s sustainability, helping platforms maintain engagement in an increasingly fragmented market.

Perspectives and Opportunities

The global crime market is entering a phase of consolidation and diversification. Key growth vectors include:

• Franchise expansion (spin-offs, shared universes) enabling scalability and long-term audience loyalty.

• Revivals, reboots, and adaptations blending nostalgia with novelty to target both existing fans and new viewers. The main challenges ahead lie in catalog saturation and the need for differentiation in an intensely competitive genre. Platforms that balance global IP extensions with locally resonant narratives are well positioned to capture sustained audience attention.

This report was featured in 221B Magazine’s MIPCOM 2025 issue.